NY residents can receive unemployment insurance benefits for up to 26 weeks if they meet the eligibility requirements. Among other things you must have lost your job through no fault of your own you must be ready willing and able to accept suitable employment and you must conduct an.

Commercial Goods Transportation Industry Fair Play Act.

Unemployment ny rules. Unemployment Insurance A Claimant Handbook The New York State Department of Labor is an Equal Opportunity employer and program provider. Eligibility for Unemployment in NY. Not qualify her for unemployment insurance benefits the form must still be provided.

It takes about 3 weeks after applying to receive your first benefits. Also workers must be determined to be unemployed through no fault of their own so if you quit or were fired you may not be eligible. You have worked and earned a minimum amount of wages in work covered by unemployment tax during the past 18 months.

You are totally unemployed. Section 4723 - Reports and payments of contributions. In order to receive unemployment benefits in New York you must follow these rules.

Workers describe chaos inside state Labor Department. Part-time workers who work four hours or less in a given week wont see any reduction in their weekly unemployment benefit. New York Unemployment Eligibility Information Unemployment insurance eligibility in New York is based on a number of different requirements.

While New York did not waive the requirements they were largely a technicality. As Unemployment Exploded New York Loosened Its Rules Labour Department New York Unemployment See the New York Department of Labor DOL resource page for more information and reader comments. New York State Unemployment Insurance Law Article 18 25B and 25C of the NYS Labor Law Construction Industry Fair Play Act.

The requirements to collect unemployment insurance in New York are similar to most other states. Typically workers need to. Workers who lose significant hours may qualify too.

The Waiting period for unemployment benefits has been waived during Covid-19. Depending on your vocation and industry you may qualify for unemployment if you have had your hours reduced. Section 4724 - Reports of remuneration and employment.

Unemployment benefits are available in instances beyond a layoff. You can also certify for weekly benefits with our automated phone system by calling 833-324-0366 for PUA or 888-581-5812 for UI. You must meet all requirements to be eligible to collect unemployment insurance in New York.

9 rows Article 1 - Regulations of the Industrial Commissioner. The MCTD includes New York City the counties of New York Manhattan Bronx Kings Brooklyn Queens Richmond Staten. Section 4722 - Employer records.

You can get paid with direct deposit or through a pre-paid debit card. That depends on where you live. Employers of New York State employees should confirm that Form IA 123 is included with the notice provided to all employees upon separation.

In order to qualify for unemployment benefits you must have worked for an employer covered by the state unemployment law and earned enough wages within a 12-month period. NY is extending the period covered by UI benefits for an extra 13 weeks 39 weeks total. But everyone who qualifies under the new rules will get an additional 600 a week until July 311.

Caps on unemployment benefits vary from state to state. You must be able to work and are not disabled. New York Unemployment Rules.

As unemployment exploded New York loosened its rules Submit submit submit. Summary of Case Law Interpretation Service Index of Benefit Claims New York Codes Rules and Regulations. You should contact your states unemployment insurance program as soon as possible after becoming unemployed.

Recent Review Letters by Adjudication Services Office ASO. Once your benefit period ends you may be able to apply for a federal unemployment benefits extension if the state is currently experiencing high unemployment rates. Auxiliary aids and services are available upon request to individuals with disabilities.

Depending on the state claims may be filed in person by telephone or online. Section 4721 - Status report. If your highest paid quarter wages were 9350 or more you must have been paid at least half of the total amount in the remaining three quarters of your base period.

The New York State Unemployment Insurance Program allows unemployed residents and non-residents to receive wage compensation benefits if they meet a set of two criteria. What are the requirements to get unemployment benefits in New York. People collecting unemployment are required to look for work three days a week and create a log of those efforts.

To receive unemployment insurance benefits you need to file a claim with the unemployment insurance program in the state where you worked. NY residents total wages paid must be at least 15 times the amount paid in their highest paid quarter. New Yorks unemployment agency determines weekly benefits for part-time workers those working less than 30 hours a week by looking at the number of hours a claimant works each week.

Calendar quarter if they are required to withhold New York State income tax from wages paid to employees and their payroll expense for all covered employees is more than 312500 for that calendar quarter. To receive unemployment compensation workers must meet the unemployment eligibility requirements for wages earned or time worked during an established usually one year period of time. For example in New York you can receive up to 504 in assistance per week while in Florida the maximum weekly benefit is 275.

Residents who are interested in applying to receive unemployment benefits must file a claim through the New. In order to start your unemployment NY unemployment requirements include the following. The person seeking unemployment benefits must have enough prior earnings from his or her employment job to qualify for benefits.

Part 472 - Contributions to State Unemployment Insurance Fund. You must be actively looking for a job and keeping a record of your job search. Qualifications for unemployment must be met by all former employees in order to receive unemployment insurance within the state.

Nys Department Of Labor On Twitter While Fpuc Benefits Have Expired Ui And Pua Benefits Have Been Extended For New Yorkers When Your Effective Days Remaining Reaches 0 During Your Benefit Year

Wsj News Graphics Wsjgraphics On Twitter Social Interaction Infographic Job

Browse Our Image Of Direct Deposit Form Social Security Benefits For Free Separation Agreement Template Contract Template Social Security Benefits

New York State Department Of Labor Update The Extended Benefits Eb Program Is Now In Effect In Nys Thanks To The Pandemic Emergency Unemployment Compensation Peuc Eb Programs New Yorkers

New York Ny Dol Unemployment Insurance Compensation After End Of Pandemic Programs What You Can Get In 2022 And Claiming Retroactive Payments News And Updates Aving To Invest

Browse Our Image Of Direct Deposit Form Social Security Benefits For Free Separation Agreement Template Contract Template Social Security Benefits

New Yorkers Seeking Unemployment Benefits Still Desperate To Reach Help Here Are Tips Syracuse Com

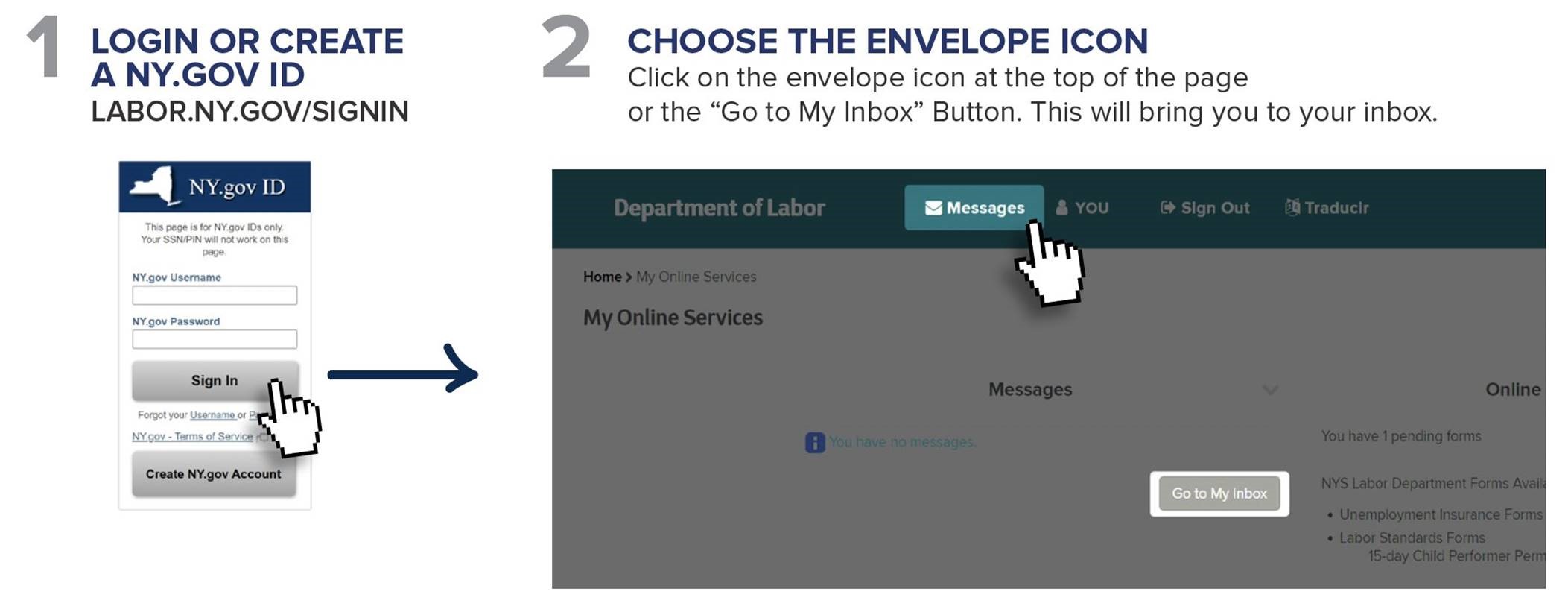

May 5 2020 Urgent Solution To Unemployment Benefits Delay Are You Still Waiting To Be Called By Dol Follow This Walkthrough Ny State Senate

As Unemployment Exploded New York Loosened Its Rules Labour Department New York Unemployment

Aspire At T People Planet Possibilities Home Schooling School High School Degree

Can I Collect Nys Unemployment Benefits Workers Compensation Syracuse Ny Workers Compensation Lawyers Mcv Law

How To Apply For Unemployment Benefits In Ny Credit Karma

How Does Unemployment Work In New York Employment Lawyers

Wsj News Graphics Wsjgraphics Twitter College Rule Education College Information Graphics

0 comments:

Post a Comment