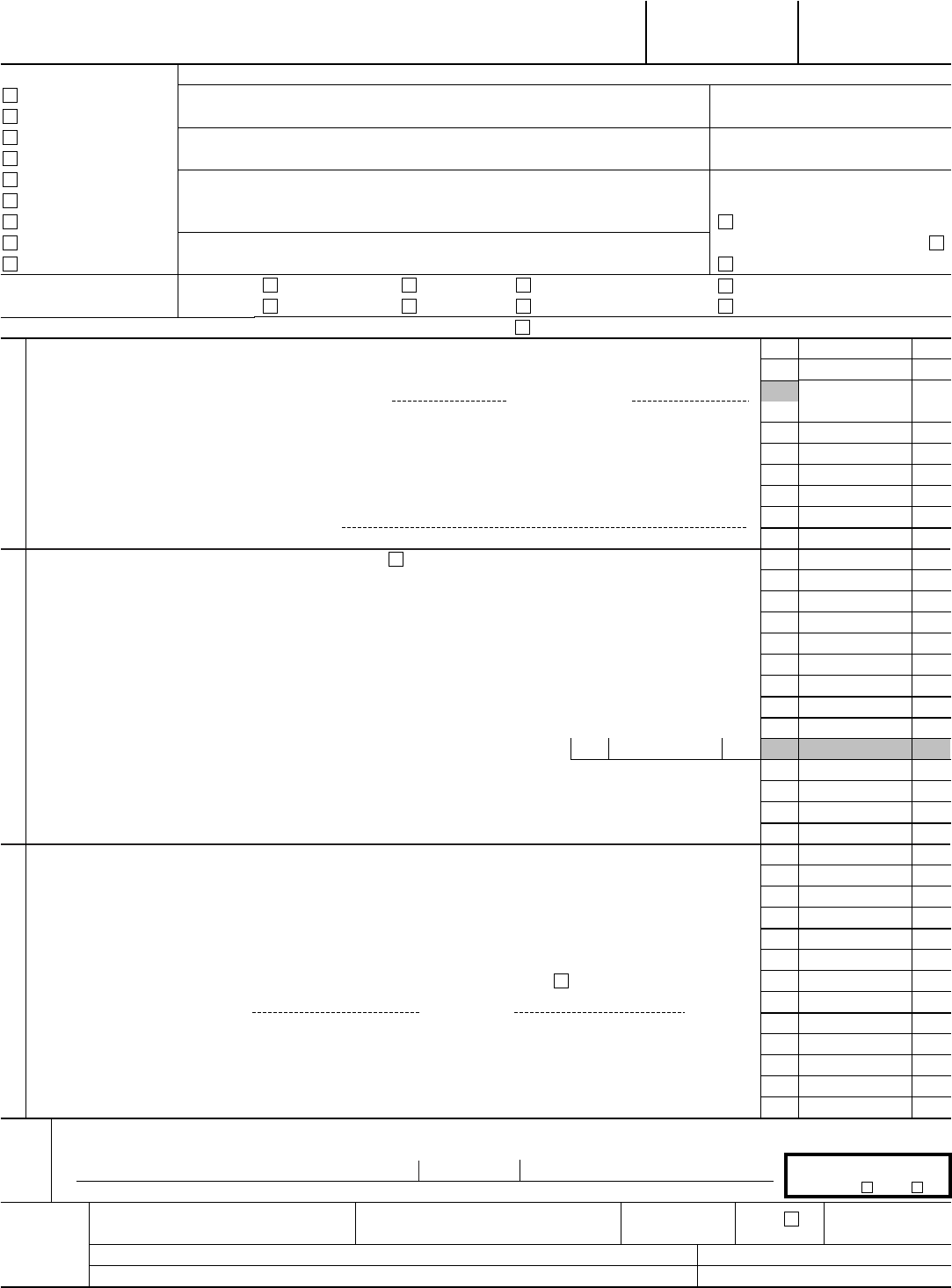

Form 1041 (Schedule I) - Alternative Minimum Tax - Estates And Trusts

www.formsbirds.com

www.formsbirds.com 1041 trusts estates

Form 1041 | Alternative Minimum Tax | Tax Deduction

www.scribd.com

www.scribd.com 1041 deduction

Form 1041 - Edit, Fill, Sign Online | Handypdf

handypdf.com

handypdf.com 1041 form irs tax printable fillable fill lifetime gift blank exemption handypdf edit pdffiller preparer deed forms related

Form 1041 Schedule D - Fill Out And Sign Printable PDF Template | SignNow

www.signnow.com

www.signnow.com 1041 irs signnow

Form 1041 Schedule D - Fill Online, Printable, Fillable Blank | Form

form-1041-instructions.com

form-1041-instructions.com 1041 irs pdffiller

2013 Form 1041 - Edit, Fill, Sign Online | Handypdf

handypdf.com

handypdf.com form 1041 handypdf

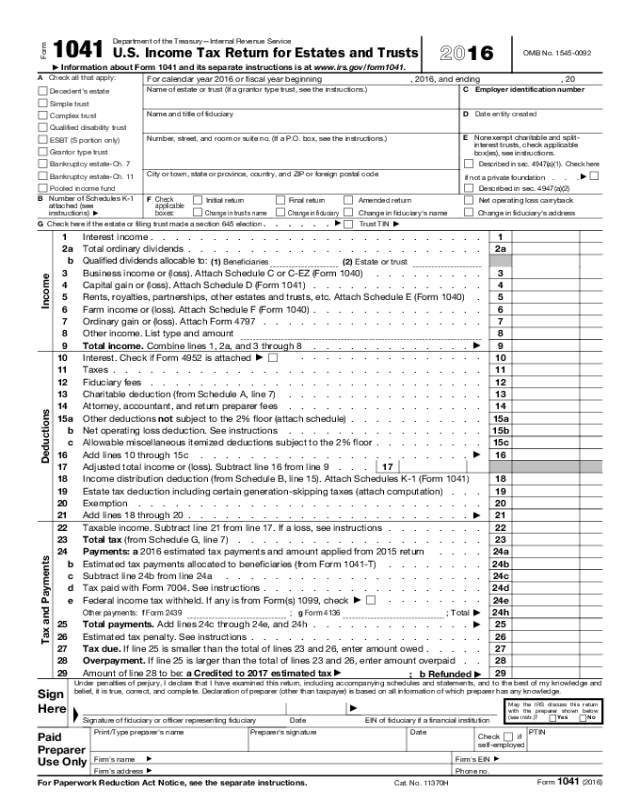

U.S. Income Tax Return For Estates And Trusts, Form 1041

us.meruaccounting.com

us.meruaccounting.com 1041 returns trusts

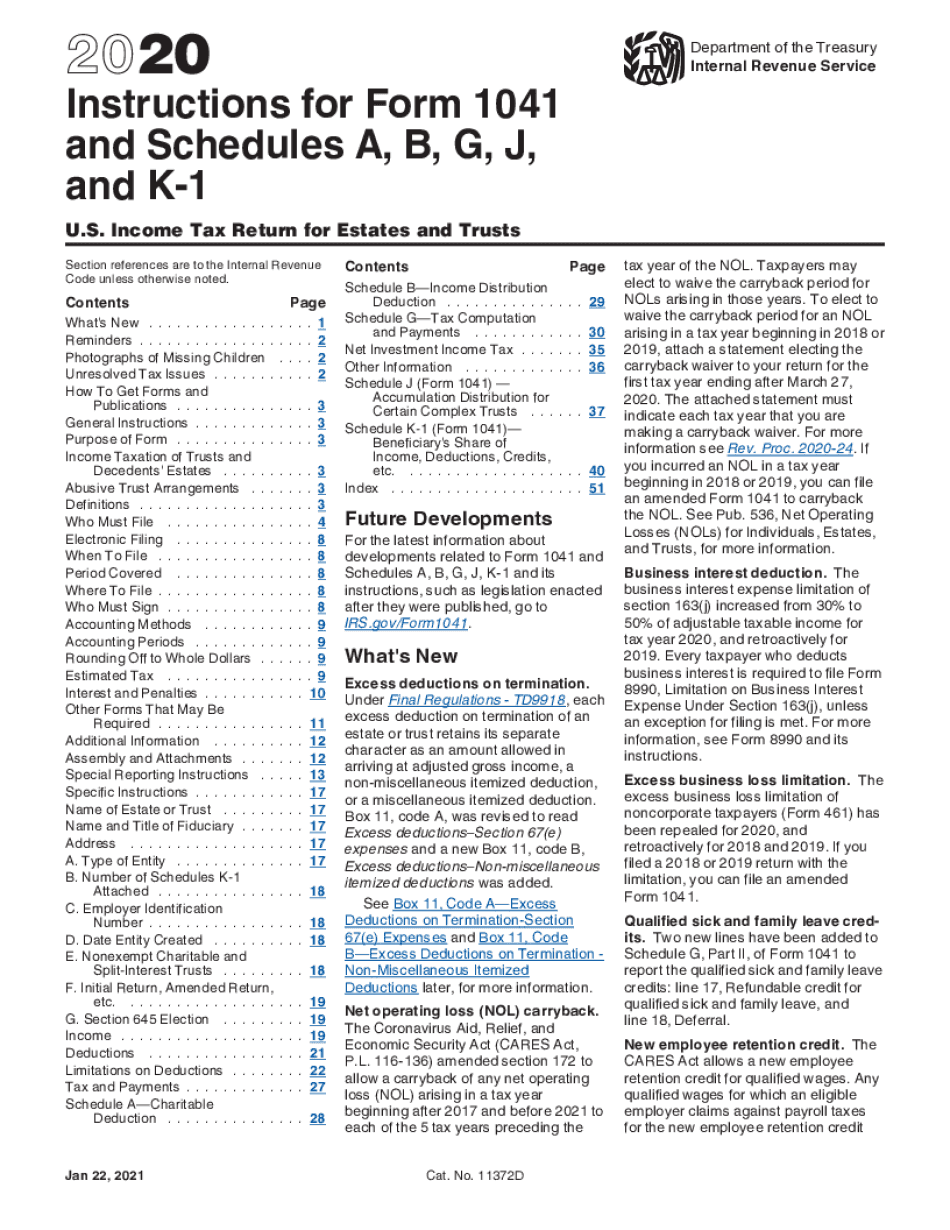

Irs Forms 1041 Instructions - Form : Resume Examples #Kw9kwxQ9JN

www.contrapositionmagazine.com

www.contrapositionmagazine.com 1041 irs

Form 1041 - U.S. Income Tax Return For Estates And Trusts (2014) Free

1041 form tax return income estates trusts estate

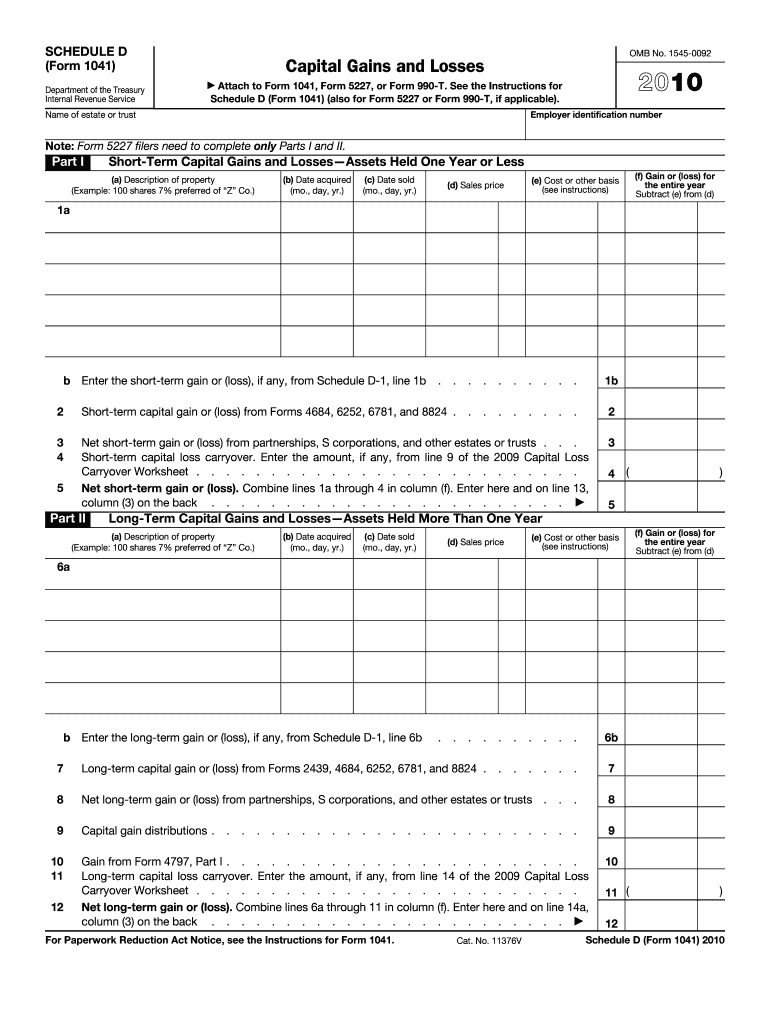

Form 1041 (Schedule D) - Capital Gains And Losses (2014) Free Download

form schedule tax capital 1041 gains forms losses irs formsbirds

1041 trusts estates. Form 1041 (schedule i). Form 1041 schedule d

Advertisement

0 comments:

Post a Comment