QBI Deduction - Frequently Asked Questions (K1, QBI, ScheduleC

kb.drakesoftware.com

kb.drakesoftware.com qbi deduction 199a section information irs their provides frequently asked questions line faqs calculated

What Is The QBI Tax Deduction And Who Can Claim It?

www.keepertax.com

www.keepertax.com What Is The QBI Tax Deduction And Who Can Claim It?

www.keepertax.com

www.keepertax.com Staying On Top Of Changes To The 20% QBI Deduction (199A) – One Year

wffacpa.com

wffacpa.com qbi 199a form 8995 deduction staying later year irs draft tax income changes

QBI Gets 'formified'

www.adjuvancy.com

www.adjuvancy.com qbi

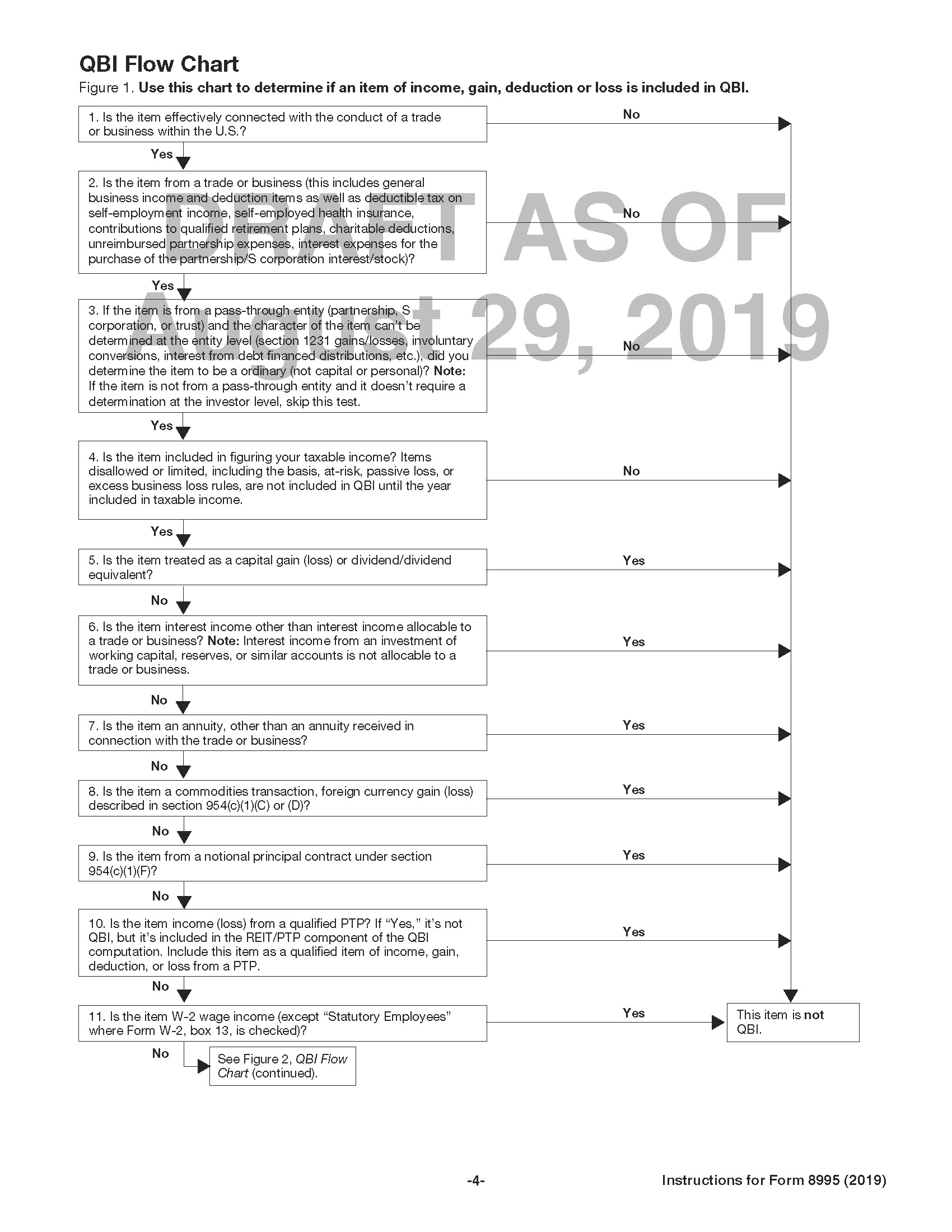

Draft Instructions To 2019 Form 8995 Contain More Informal IRS Guidance

www.currentfederaltaxdevelopments.com

www.currentfederaltaxdevelopments.com qbi irs informal flowchart

QBI Deduction - Frequently Asked Questions (K1, QBI, ScheduleC

kb.drakesoftware.com

kb.drakesoftware.com qbi deduction overrides needed

Form 1065 K-1 "Statement A - QBI Pass-through Entity Reporting" Data

www.pinterest.com

www.pinterest.com QBI Deduction - Frequently Asked Questions (K1, QBI, ScheduleC

kb.drakesoftware.com

kb.drakesoftware.com qbi deduction 8995

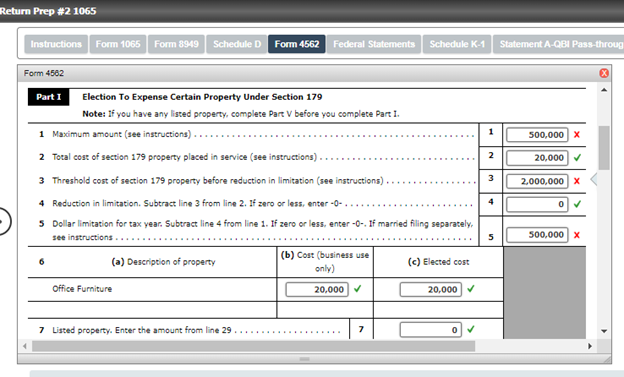

Solved Ryan Ross (111-11-1112), Oscar Omega (222-22-2223), | Chegg.com

www.chegg.com

www.chegg.com Qbi deduction overrides needed. Qbi deduction. Draft instructions to 2019 form 8995 contain more informal irs guidance

Advertisement

0 comments:

Post a Comment