What Is IRS Form 1099-Q? - TurboTax Tax Tips & Videos

turbotax.intuit.com

turbotax.intuit.com 1099 form forms misc printable where irs blank tax income turbotax alabama living fillable benefits 529 college school plan examples

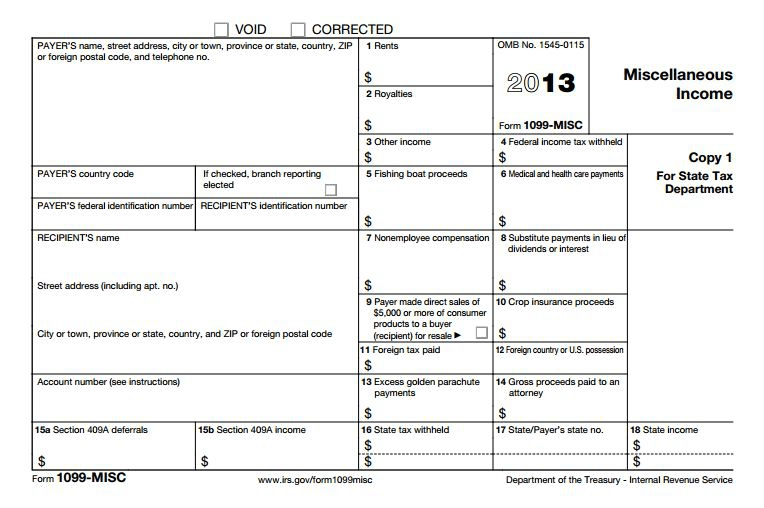

Form 1099-MISC Miscellaneous Income, Payer Copy C

www.phoenixphive.com

www.phoenixphive.com 1099 copy form miscellaneous misc income payer quantity

Form 1099 Misc Fillable | Universal Network

www.universalnetworkcable.com

www.universalnetworkcable.com 1099 fillable irs critical universalnetworkcable

1099 Form Changes For 2013 And Dynamics AX 2012 | Stoneridge Software

stoneridgesoftware.com

stoneridgesoftware.com 1099 form misc independent contractors tax contractor due ax dynamics changes january file questions irs stub paycheck recipient navigation post

How To Calculate Taxable Amount On A 1099-R For Life Insurance

theinsuranceproblog.com

theinsuranceproblog.com 1099 int insurance life example amount taxable tax reporting go

Understanding Tax Form 1099-INT • Novel Investor

novelinvestor.com

novelinvestor.com 1099 form int tax consolidated account brokerage forms filing investment income taxes massachusetts boxes looks same understanding included investments

What Is A 1099-Misc Form? | Financial Strategy Center

form 1099 misc example forms issued person individual company entity needs

How To Interpret A 1099-MISC

squareup.com

squareup.com 1099 misc form read interpret

Eagle Life Tax Form 1099-R For Annuity Distribution

1099 form tax annuity distribution forms look roth rmd american information eagle conversion payout rollover life important equity 1035 exchange

IRS Form 1099 Reporting For Small Business Owners

fitsmallbusiness.com

fitsmallbusiness.com 1099 form irs business reporting printable owners small sample rents vendors misc example w9 template letter fillable fitsmallbusiness

1099 int insurance life example amount taxable tax reporting go. How to interpret a 1099-misc. What is a 1099-misc form?

0 comments:

Post a Comment