A number of states and the District of Columbia have payroll-related changes that will take effect in the new year. The MES Act provides for a reduced taxable wage base if the UIA Trust Fund balance reaches or exceeds 25 B for two consecutive quarters.

Labor And Economic Opportunity December 2021

The 2021 taxable wage base for employers in the highest SUI tax rate group is 26100.

Michigan unemployment wage base 2022. Does the change in the taxable wage base mean I need to make internal programming changes to my system. A rise in the minimum wage has been a popular topic in Michigan and nationally and Michigan is among 22 states increasing their minimum wage rates in 2022. The increase to the 2021 SUI taxable wage base up from 9000 in 2020 was confirmed by the Michigan Unemployment Insurance Agency UIA.

Michigan law currently prescribes that an automatic increase in the taxable wage base-part of the formula that determines how much unemployment taxes an employer must pay- will occur if the. The Michigan Wage Hour Division announced Thursday that the base minimum wage for the state will increase to 987 per hour in 2022. The OSE recommends a base-wage increase of 2 effective October 1 2021 and a 1 base-wage increase effective the first full pay period in April 2022.

Michigans UI law requires that the SUI taxable wage base increase to 9500 for any calendar year that the states UI trust fund balance was less than 25 billion on the previous June 30EY tax alert 2021-0465 3-1-2021. The base minimum wage for tipped hourly employees is also going up with a. The taxable wage base will continue to increase as follows.

For each year thereafter computed as 16 of the states average annual wage. The state has one wage base for 2021 it will be 9500 for all employers. If the balance is lower the wage base increases.

To access from the APA home page select Compliance and then State Unemployment Wage Bases under Overview The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA taxable wage base of 7000 per employee and most states have wage bases. Michigans minimum wage rate will increase to 987 from the current 965 as. I am a third-party payroll provider.

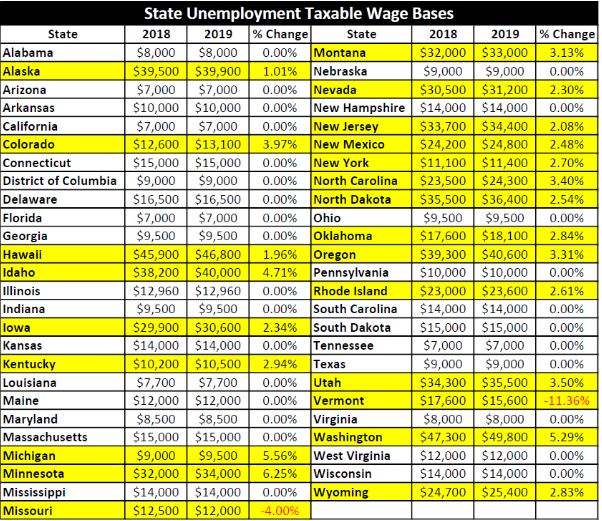

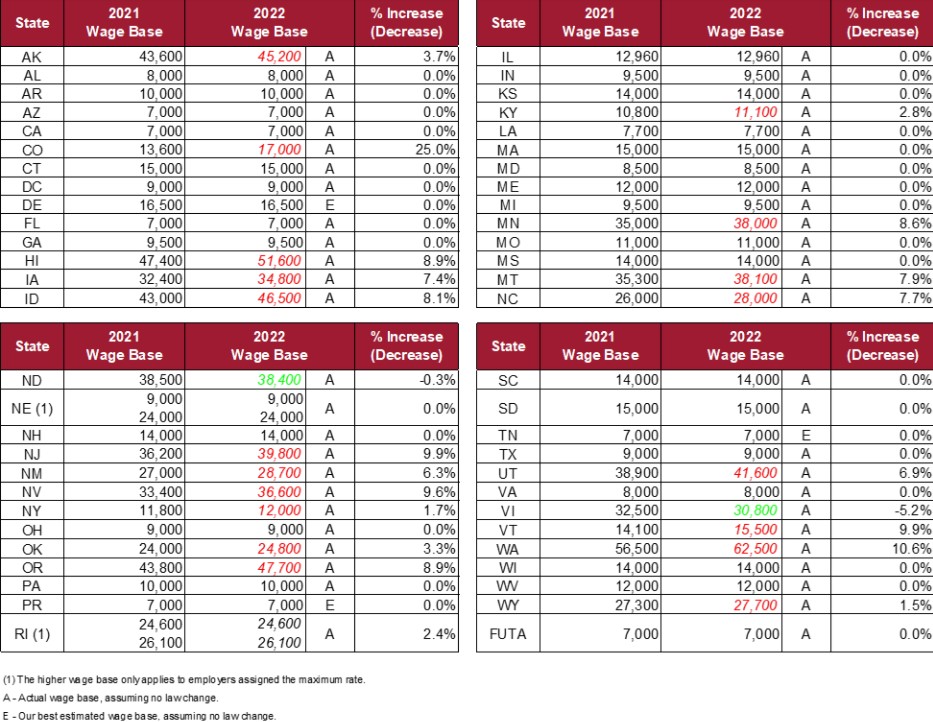

Will the 9500 taxable wage base be reflected in my tax account when my quarterly reports are filed. The list of state wage bases is from 2019 to 2022. Unemployment tax rates for 2022 are to range from 0725 to 7625.

1 2022 the unemployment-taxable wage base is to be 12960 the department said in a notice pertaining to unemployment tax rate calculations. Recently introduced HB 6136 would if enacted provide that the Michigan state unemployment insurance SUI taxable wage base would remain at 9000 for calendar year 2021 rather than increase to 9500 due to a decrease in the states UI trust fund. For each year thereafter computed as 16 of the states average annual wage.

For each year thereafter computed as 16 of the states average annual wage. How does the taxable wage base affect my organizations unemployment tax liability. The taxable wage base will continue to increase as follows.

2022 Wage Base Limit 2021 Wage Base Limit 2020 Wage Base Limit State Agency Website and Phone Number. Michigan UIA website State ends EB and PUA UI benefits. The new law stops any further increase in the unemployment taxable wage base in 2022.

Among changes that come with the new year is an increase in hourly pay for Michiganders set for Jan. Unemployment Insurance Agency What is the current taxable wage base. Thi s proposal is consistent with tentative agreements for FY 2022 wages negotiated in seven collective bargaining agreements recently entered with exclusive representatives.

The UIA 2022 taxable wage base for employers will be 9500. These changes include minimum wage changes updated state unemployment wage bases and new paid sick leave laws. The taxable wage base is 9500.

The wage base fluctuates with the balance in the states unemployment trust fund. Federal and State Payroll Updates - 2022. The taxable wage base will continue to increase as follows.

In 2020 the Trust Fund balance fell below 25B therefore the 2021 taxable wage base is 9500. It was 7000 in 2020. For 2021 the wage base was 10000.

Michigan pending legislation would hold the SUI taxable wage base at 9000 for calendar year 2021. 2022 STATE WAGE BASES Updated 012022 2021 STATE WAGE BASES 2020 STATE WAGE BASES 2019 STATE WAGE BASES. How to Apply for UI 877600-2722.

Finally if you would like to suggest articles or topics for this newsletter or would like to nominate your company to participate in Michigan Employer Advisor Focus Group please send a message to UIA-EmployerAdvisorMichigangov. Consequently the employer SUI taxable wage base will increase to 9500 for 2021 unless the state legislature reintroduces and enacts similar legislation during the 20212022 legislative session. This week HB 6136 Hall was introduced to prevent an automatic increase in unemployment taxes for Michigan job providers.

The maximum amount the wage base can be is 12000. The state minimum wage currently is set at 965 per hour. A current listing of enacted leave laws can also be found by clicking here.

The reduced wage base for non-delinquent employers is not valid as the Michigan Unemployment Trust Fund has fallen below the required threshold. Michigans base minimum wage has gone up to 987 an increase of 022 from the previous hourly wage of 965. September 3 2020.

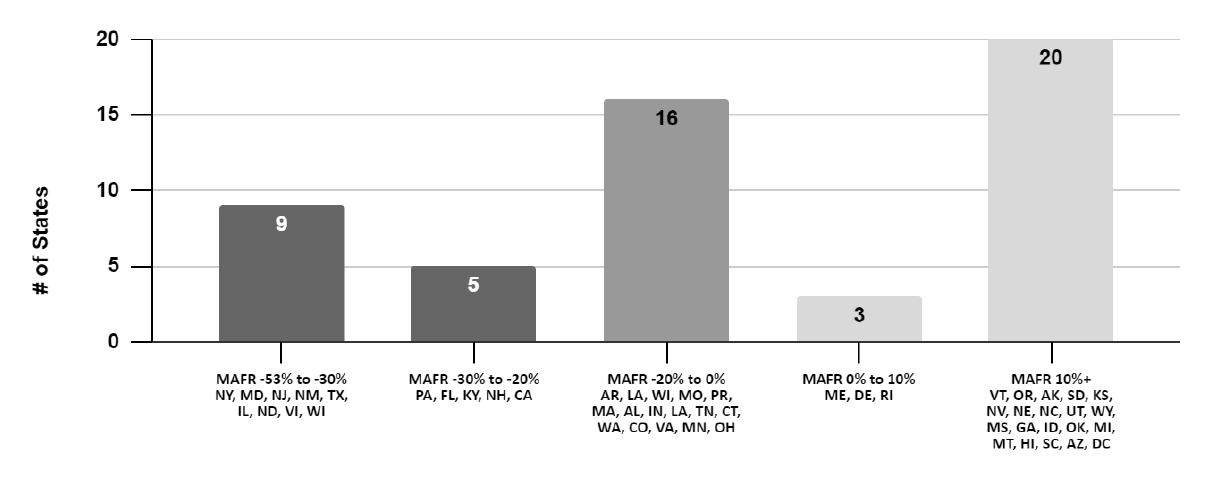

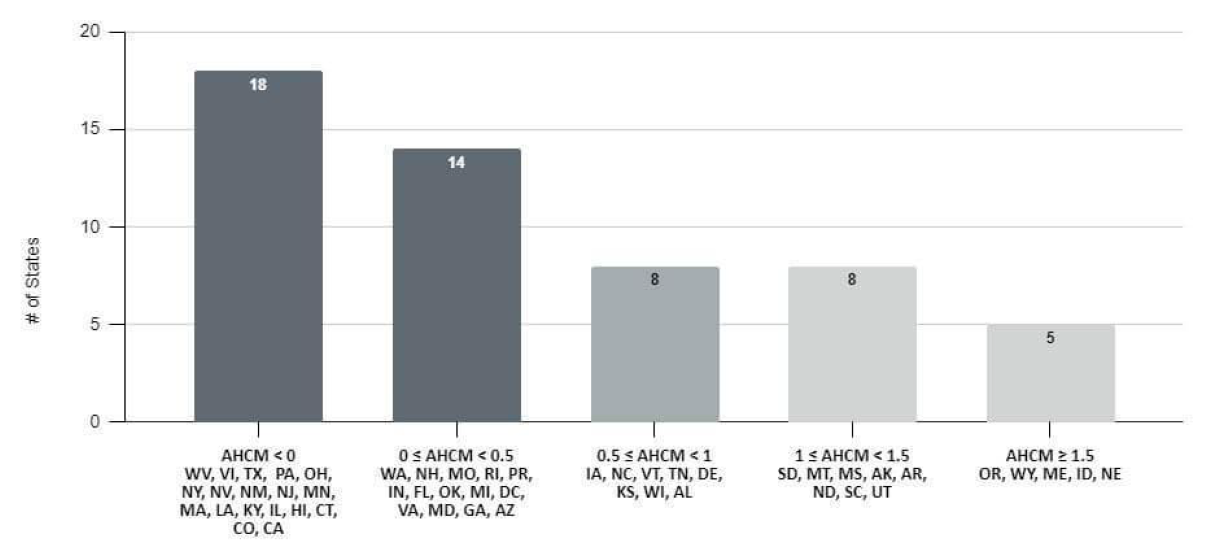

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

What You Need To Know About Michigan S New Minimum Wage Sick Pay Laws Mlive Com

Labor And Economic Opportunity December 2021

2022 State Minimum Wage Rates Govdocs

Labor And Economic Opportunity December 2021

Unemployment And Payroll Indicators Detroit Regional Chamber

Michigan Taxable Wage Base Increases To 9 500

Coronavirus Uia Update Michigan Activates Federal Extended Benefits

Labor And Economic Opportunity December 2021

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

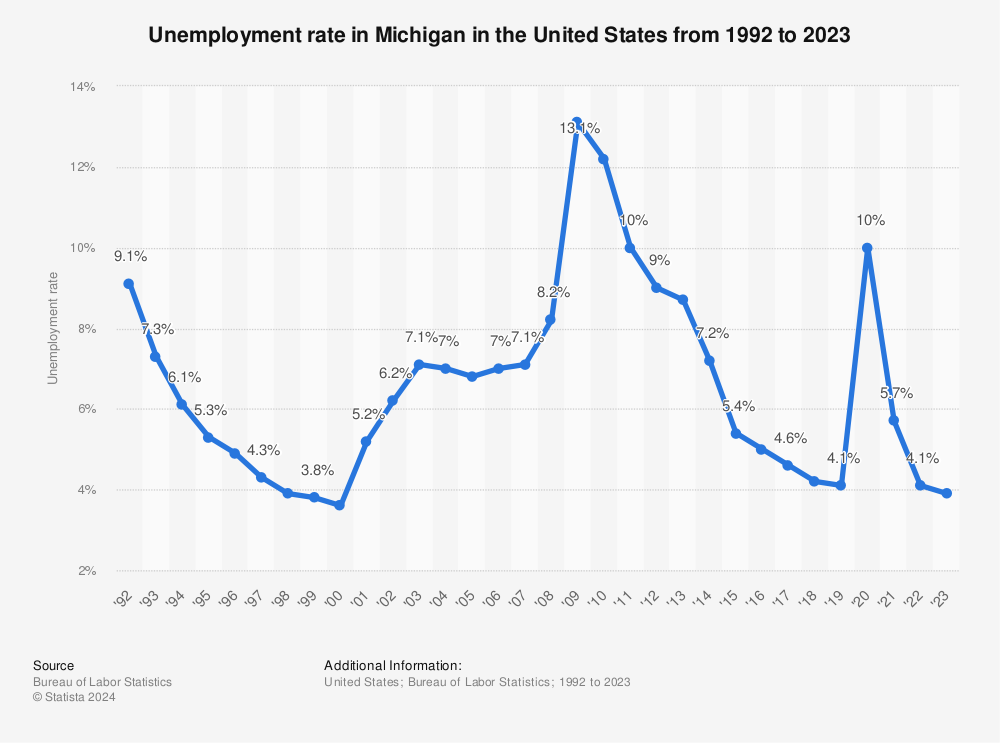

Michigan Unemployment Rate 2020 Statista

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

0 comments:

Post a Comment