When certifying for benefits New Yorkers should refer the new guidelines for reporting part-time work available here. Instead benefits will be reduced in.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22253262/unnamed.jpg)

Change For Part Time Workers Receiving Unemployment Benefits The City

With this change your benefits will not be reduced for each day you engage in part-time work.

Nys unemployment guidelines. New Unemployment Insurance claims filed on and after. New York State Unemployment Insurance Law Article 18 25B and 25C of the NYS Labor Law Construction Industry Fair Play Act. Under the new rules you can work up to 7 days per week without losing full unemployment benefits for that week if you work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment.

Effective January 1 2021 New Yorks paid sick leave law requires employers with five or more employees or net income of more than 1 million to provide paid sick leave to employees and for employers with fewer than five employees and a net income of 1 million or less to provide unpaid sick leave to employees. To substantiate your claim you should keep a record of your work search dates contacts and other pertinent efforts to validate your claim. Unemployment Insurance provides benefits to workers who lose their job through no fault of their own and is funded by employer contributions.

In order to start your unemployment NY unemployment requirements include the following. Auxiliary aids and services are available upon request to individuals with disabilities. Following the expiration of New York States COVID-19 State of Emergency the Unemployment Insurance unpaid waiting period rule is once again in effect.

Dec 13 2021 When certifying for benefits New Yorkers should refer the new guidelines for reporting part-time work available here. Following the expiration of New York States COVID-19 State of Emergency the Unemployment Insurance unpaid waiting period rule is once again in effect. Here are the basic rules for collecting unemployment compensation in New York.

With rapid industrialization running parallel to the number of people getting their college degrees the available employment has taken s. Many people may be eligible and we are told you have to apply and be denied regular UI first before you can apply for Pandemic Unemployment. Unemployment Insurance A Claimant Handbook The New York State Department of Labor is an Equal Opportunity employer and program provider.

To receive unemployment compensation workers must meet the unemployment eligibility requirements for wages earned or time worked during an established usually one year period of time. You must make a reasonable effort to find suitable full-time work. OVERVIEW OF UNEMPLOYMENT INSURANCE IN NYS DURING COVID-19 ELIGIBILITY REQUIREMENTS OVERVIEW.

Waiting Week Update 62821. Page 1 of 1 1. To be eligible to receive unemployment benefits in New York you must meet the following requirements.

Failure to file on time may result in penalties and interest as well as increased contribution rates and loss of credit on IRS Form 940. Unemployment Insurance Employment Guide P 820 This publication will explain the Unemployment Insurance program in more detail and will answer many of your questions. NYS Department of Labor Unemployment Insurance Employer Guide You must electronically file your NYS 45 return and pay your contributions quarterly.

Former employees must have worked and been paid wages in at least two calendar quarters by companies who have unemployment insurance. You are totally unemployed. NY residents can receive unemployment insurance benefits for up to 26 weeks if they meet the eligibility requirementsOnce your benefit period ends you may be able to apply for a federal unemployment benefits extension if the state is currently experiencing high unemployment rates.

Waiting Week Update 62821. Past workers must have been paid at least 1900 in one calendar quarter. Employer rights responsibilities and filing requirements New York State unemployment insurance New York State wage reporting.

You have worked and earned a minimum amount of wages in work covered by unemployment tax during the past 18 months. New Unemployment Insurance claims filed on and after. How long do you have to work to collect unemployment in NY.

Employers Guide to Unemployment Insurance Wage Reporting and Withholding Tax Revised December 2021 NYS-50 1221 This booklet contains information on. You are totally unemployed. Your past earnings must meet certain minimum thresholds.

New York State Unemployment Program Comprehensive Guide. NY residents total wages paid must be at least 15 times the amount paid in their highest paid quarter. To claim unemployment benefits in New York fully and partially unemployed workers must qualify according to state requirements.

In New York as in every other state employees who are temporarily out of work through no fault of their own may qualify to collect unemployment benefitsThe eligibility rules prior earnings requirements benefit amounts and other details vary from state to state however. The three eligibility requirements to collect unemployment benefits in New York are. In order to receive unemployment benefits in New York you must have been employed for paid work for at least 2 calendar quarters during your Base Period a Base Period is one year or 4 calendar quarters.

New Unemployment Insurance claims filed on and after. Also workers must be determined to be unemployed through no fault of their own so if you quit or were fired you may not be eligible. Regular Unemployment Insurance UI.

Depending on your vocation and industry you may qualify for unemployment if you have had your hours reduced. In order to start your unemployment NY unemployment requirements include the following. Commercial Goods Transportation Industry Fair Play Act.

New York State Paid Sick Leave Law. Depending on your vocation and industry you may qualify for unemployment if you have had your hours reduced. Summary of Case Law Interpretation Service Index of Benefit Claims New York Codes Rules and Regulations.

Following the expiration of New York States COVID-19 State of Emergency the Unemployment Insurance unpaid waiting period rule is once again in effect. Waiting Week Update 62821. New York unemployment benefits claims are for residents who are unemployed through no fault of their own have adequate employment history and are actively seeking new employment opportunities.

You must be unemployed through no fault of your own as defined by New York law. You must file even if you owe no contributions. Dec 13 2021 When certifying for benefits New Yorkers should refer the new guidelines for reporting part-time work available here.

Can I Collect Nys Unemployment Benefits Workers Compensation Syracuse Ny Workers Compensation Lawyers Mcv Law

May 5 2020 Urgent Solution To Unemployment Benefits Delay Are You Still Waiting To Be Called By Dol Follow This Walkthrough Ny State Senate

May 5 2020 Urgent Solution To Unemployment Benefits Delay Are You Still Waiting To Be Called By Dol Follow This Walkthrough Ny State Senate

May 5 2020 Urgent Solution To Unemployment Benefits Delay Are You Still Waiting To Be Called By Dol Follow This Walkthrough Ny State Senate

New York State Department Of Labor Update The Extended Benefits Eb Program Is Now In Effect In Nys Thanks To The Pandemic Emergency Unemployment Compensation Peuc Eb Programs New Yorkers

New Yorkers Seeking Unemployment Benefits Still Desperate To Reach Help Here Are Tips Syracuse Com

Nys Department Of Labor Nyslabor Twitter

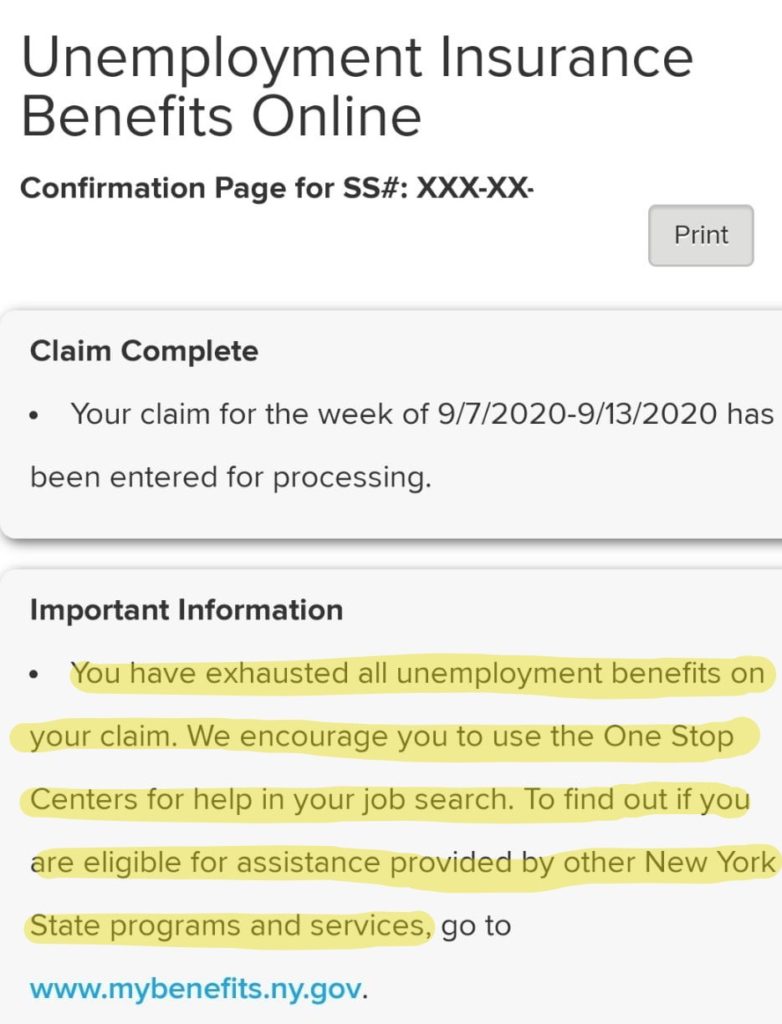

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

How Does Unemployment Work In New York Employment Lawyers

Certify For Weekly Unemployment Insurance Benefits Department Of Labor

New York Ny Dol Unemployment Insurance Compensation After End Of Pandemic Programs What You Can Get In 2022 And Claiming Retroactive Payments News And Updates Aving To Invest

0 comments:

Post a Comment