It evaluates individual claimant. Initial claims are applications for unemployment benefits which may or may not result in an applicant receiving them.

Ct Dept Of Labor Unemployment Rate Private Sector Employment Up

File a claimant appeal online.

Ct unemployment benefits services. File for Pandemic Unemployment Assistance PUA File your weekly PUA certification. Under Connecticut state law an unemployed person who qualifies for UI benefits can get their weekly benefit for up to 26 weeks. You may just be looking for a weekly unemployment check but CT unemployment benefits provide so much more than just money.

Thanks to multiple application methods deciding where to sign up for unemployment is easier than ever. This is the agency to which unemployment insurance UI claims are submitted. Connecticut law provides for up to 26 weeks of unemployment insurance.

For example Connecticut unemployment benefits include. Get tax info 1099G form File your application for Extended Benefits EB Received an extended benefits letter. This website is available Monday - Friday from 600 am.

Employer Unemployment Tax Filing. This website can also help with basic inquiries related to an unemployment claim and is available in both English and Spanish and offers the ability to request an address Documents Required. Job and skill re-training services.

Information about other resources and services. You must be totally or partially unemployed. Jobs data economic information workforce analysis.

Applicants now have the ability to file an online application for unemployment in Connecticut making the overall process much faster and more straightforward. - Yahoo Search Results. SIDES E-Response Registration for employers Employer Resources.

The states CT Direct Benefits is the system that is used to administer and process benefit requests. Connecticut employers can file unemployment taxes get necessary forms and understand benefit payment procedures here. Select a benefits payment option.

UC-1099G Tax Form Information The UC-1099G Tax Form details the amount of unemployment benefits an employee received for a specific tax year. The Connecticut Department of Labor administers unemployment insurance benefits for workers in the state who are either partially or fully unemployed and who are either looking for new jobs in training or waiting to be recalled back to their jobs. A Guide to Your Rights Responsibilities When Claiming Unemployment Benefits in Connecticut Basic Eligibility Requirements.

Department of Aging and Disability Services. What is the unemployment benefits in CT. The states unemployment insurance program is managed by the Connecticut Department of Labor DOL.

The Connecticut Department of Labors DOL Initial Claims data is an important resource to understand the economic impact of the COVID-19 crisis on the state of Connecticut. File an employer appeal online. Individuals who filed a claim prior to this date and who have been collecting unemployment insurance benefits are.

Recruitment training assistance Labor Relations Mediation Arbitration unemployment taxes resources forms. The revised rate is 18 above the current 631 weekly maximum rate and will apply to claims filed for the benefit year starting on and after October 6 2019. No fee Application Process.

Connecticut Unemployment Eligibility Information Many unemployed residents wish to know how to qualify for unemployment benefits in the state of Connecticut and what steps they can take to secure unemployment insurance. Claiming benefits for unemployment is a straightforward process that can either be completed online or over the phone. However jobless Connecticut residents will soon no longer qualify for federal extended unemployment benefits.

For the 12 months ending August 31 2019 unemployment insurance benefits averaged 39394 per week and claimants received an average of 163 weeks of compensation. People who arent covered by the Unemployment. If you receive disability cash or medical benefits such as Social Security Disability Insurance Supplemental Security Income State Supplement Medicare andor Medicaid you may qualify for disability benefits that allow you to work and still receive benefits.

Amount and Duration of Unemployment Benefits in Connecticut The DOL determines your weekly benefit amount by averaging your wages from the two highest quarters in. EST and Saturday from 600 am. Extended Benefits a 13-week extension to regular state unemployment benefits expire when the states three-month average unemployment rate falls below 65.

While unemployment can be a valuable resource for those who are between jobs it is important to be sure that you fall within the necessary. Applying for Benefits in Connecticut. Unemployment Insurance is temporary income for workers who are unemployed through no fault of their own and who are either looking for new jobs in approved training or are awaiting recall to employment.

Unemployment Online Assistance Center. You can also continue to. Connecticut law provides for up to 26 weeks of unemployment insurance.

As expected with the declining unemployment rate Connecticut has triggered off the federal Extended Benefits program. Extended federal unemployment benefits in CT to end soon. Department of Revenue Services.

Connecticut unemployment registration does not need to be an overwhelming ordeal. It is vital that. In most cases the maximum number of weeks you can receive unemployment benefits is 26 weeks unless you are given an unemployment benefits extension during a time of high statewide unemployment.

In the state of Connecticut employees who are temporarily out of work through no fault of their own may qualify for unemployment insurance benefits. Find more information about the benefits offered. Department of Labor Eligibility requirements for filing unemployment claims can be found as well as insurance information on weekly requirements and maximum entitlement.

You must be monetarily eligible. Trade Readjustment Assistance Services. Taxation of Unemployment Compensation Connecticut residents are subject to Connecticut income tax on unemployment benefits accrued.

Incumbent Worker Training Program can provide your company with up to 50000 in matching funds. You can receive benefits if you meet a series of legal eligibility requirements.

Hartford American Job Center Contact Information

Norwich American Job Center Contact Information

World S Largest Professional Network Employment Service American Jobs Job Center

Torrington American Job Center Contact Information

Waterbury American Job Center Contact Information

American Rescue Plan Federal Programs

Ct Lawmakers Call On State To Forgive Unemployment Overpayments

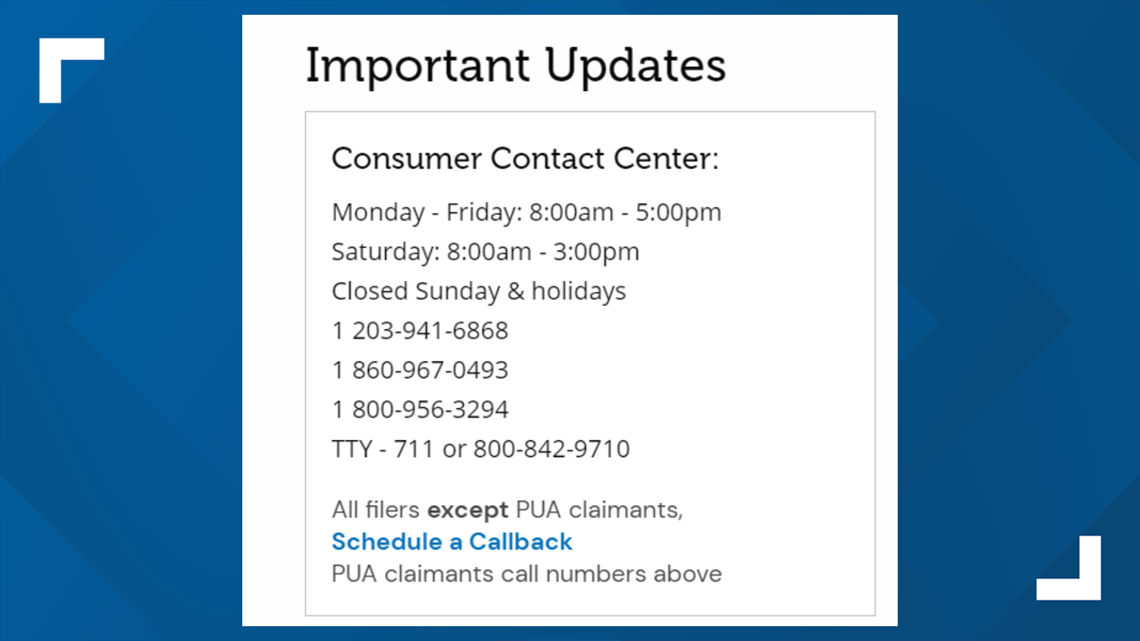

Connecticut Unemployment Helpline Phone Number Fox61 Com

Bureau Of Rehabilitation Services

Ct Department Of Labor Announces Customer Contact Center To Help With Unemployment Claims Connecticut News Wfsb Com

0 comments:

Post a Comment