94 rows ARRA. If you applied for unemployment insurance UI benefits last year you may be nearing your benefit year ending BYE date.

Social Protection Statistics Unemployment Benefits Statistics Explained

78-year-old real estate broker waiting 18 months for unemployment benefits turns to News 6 DEO on track to build new system to replace Connect by 2023 Mike Holfeld Investigative Reporter.

Unemployment benefits year. Anyone who needs to certify for benefits should do so early in the week. The BYE date generally falls on the week ending date from when the claim was first paid twelve months ago. 1 2019 through Sept.

Most states define your benefit year as the 12 month period after you filed your claim for benefits. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. The SSS unemployment benefits claim must be filed within one 1 year from the date of involuntary separation.

Your benefits may even raise you into a higher income tax bracket though you shouldnt worry too much. 30 and 31 to observe the New Years holiday. This number can vary as the.

In most states the average unemployed person can receive up to 378 weekly in unemployment payments according to US. You cannot be paid for weeks of unemployment after your benefit year ends even if you have a balance on your claim. The American Rescue Plan Act signed into law in March 2021 and providing an extension of the 300 weekly federal unemployment insurance supplement as well as some other new provisions was ended September 6 2021.

Labor Department data as of year-end 2019. For example if you applied for unemployment benefits on Jan. A Guide to COVID-19 Unemployment Benefits by State.

Typically the end of the benefit year means the jobless would have to establish a new claim to determine eligibility for benefits and to. The intent of the act was to provide an economic safety net for people when they lost their jobs while also stabilizing the economy. A regular unemployment insurance benefit year ends 12 months after the claim started.

You can apply for extended benefits only once youve run out of regular benefits. Claims for jobless benefits began ticking up the week of March 14 2020 as the coronavirus sent shock waves through. What is Benefit Year End BYE.

As of September 5 2021 several federal unemployment benefit programs including PUA PEUC EB and the FPUC and MEUC supplements have expired per federal law. You must report unemployment benefits as income on your tax return. According to federal rules a regular Unemployment Insurance UI claim expires after one year.

Originally recipients would be eligible for a maximum of 16 weeks of benefits. Federal Benefits Ending. Some states ended the distribution of the.

Continue to certify for benefits if you have weeks available within your benefit year. In most cases today that number is now 26 weeks of benefits. Expiration of your benefit year occurs 52 weeks after you first filed your claim.

Heres what that means for you. 6 the federal government had supplemented state unemployment insurance programs by paying an extra payment of 300 a week and extending benefits to gig workers and to those who were. If you received unemployment benefits in 2021 you will owe income taxes on that amount.

Thats the lowest four-week moving average since October 1969 the Labor Department reported Thursday. Your base year is the first four of the last five completed calendar quarters before the week in which you apply for benefits. Extended unemployment insurance benefits last for 13 weeks.

You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. The average number of weekly jobless benefits claims over the past four weeks fell to 199250. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

So the ending date of the claim is referred to as the benefit year end or BYE date. For example many regular UI claims had a Benefit Year Begin BYB date of 3152020 meaning they will have a Benefit Year End BYE date of 3132021. However if the deadline falls on March 5 2020 up until the last.

20 2021 your base year would include wages earned from Oct. Unemployment Income Rules for Tax Year 2021. Unemployed workers can certify for benefits online using the Michigan Web Account Manager MiWAM but certification by.

The Unemployment Insurance Agency UIA will be closed Dec. Other Types of Benefits and Programs for the Unemployed Educational Help. Benefit Year End Date.

While federal income taxes were waived on up to 10200 of unemployment benefits for the 2020 tax year theres been nothing to indicate that taxpayers should expect a similar break for 2021. For more information visit dolnygovfedexp. Check with your state.

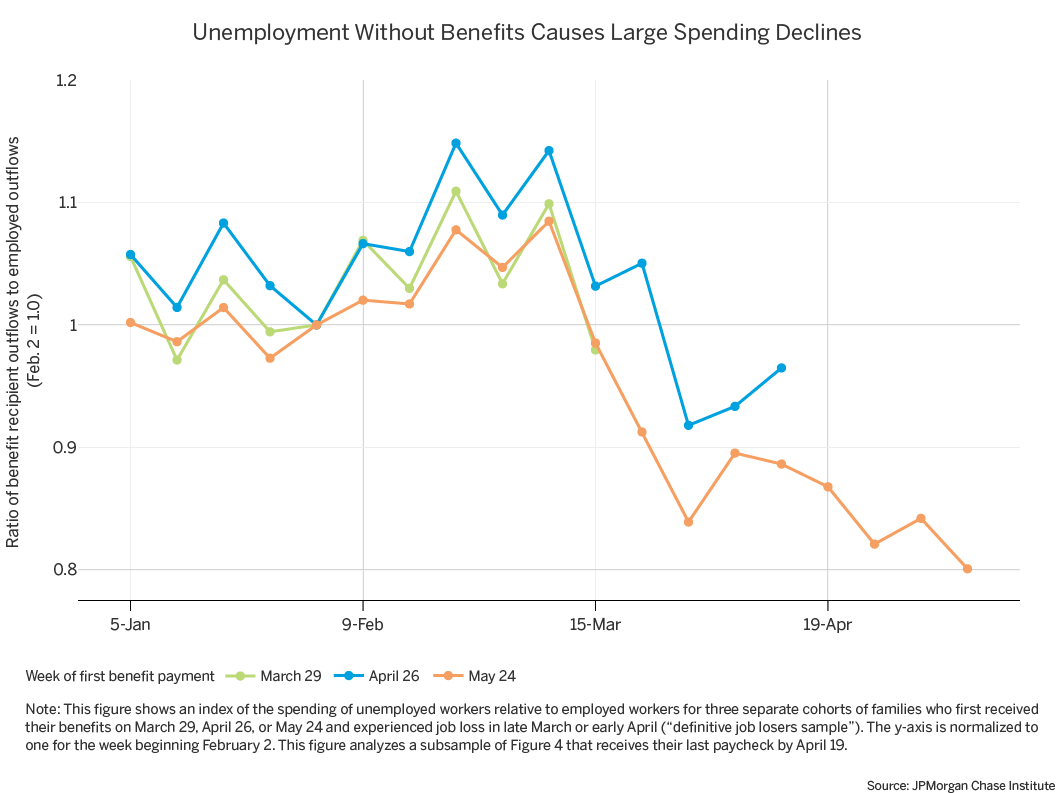

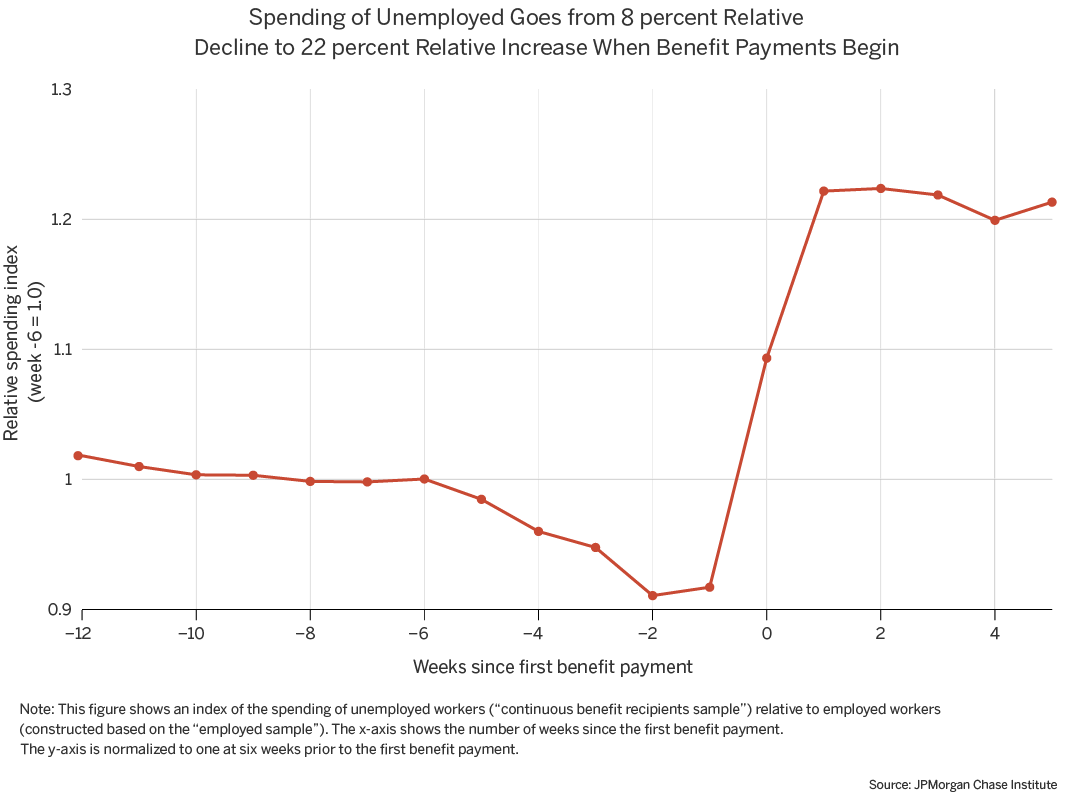

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Unemployment Insurance Data Employment Training Administration Eta U S Department Of Labor

2 1 Million Unemployment Claims Push Total Past 40 Million The New York Times

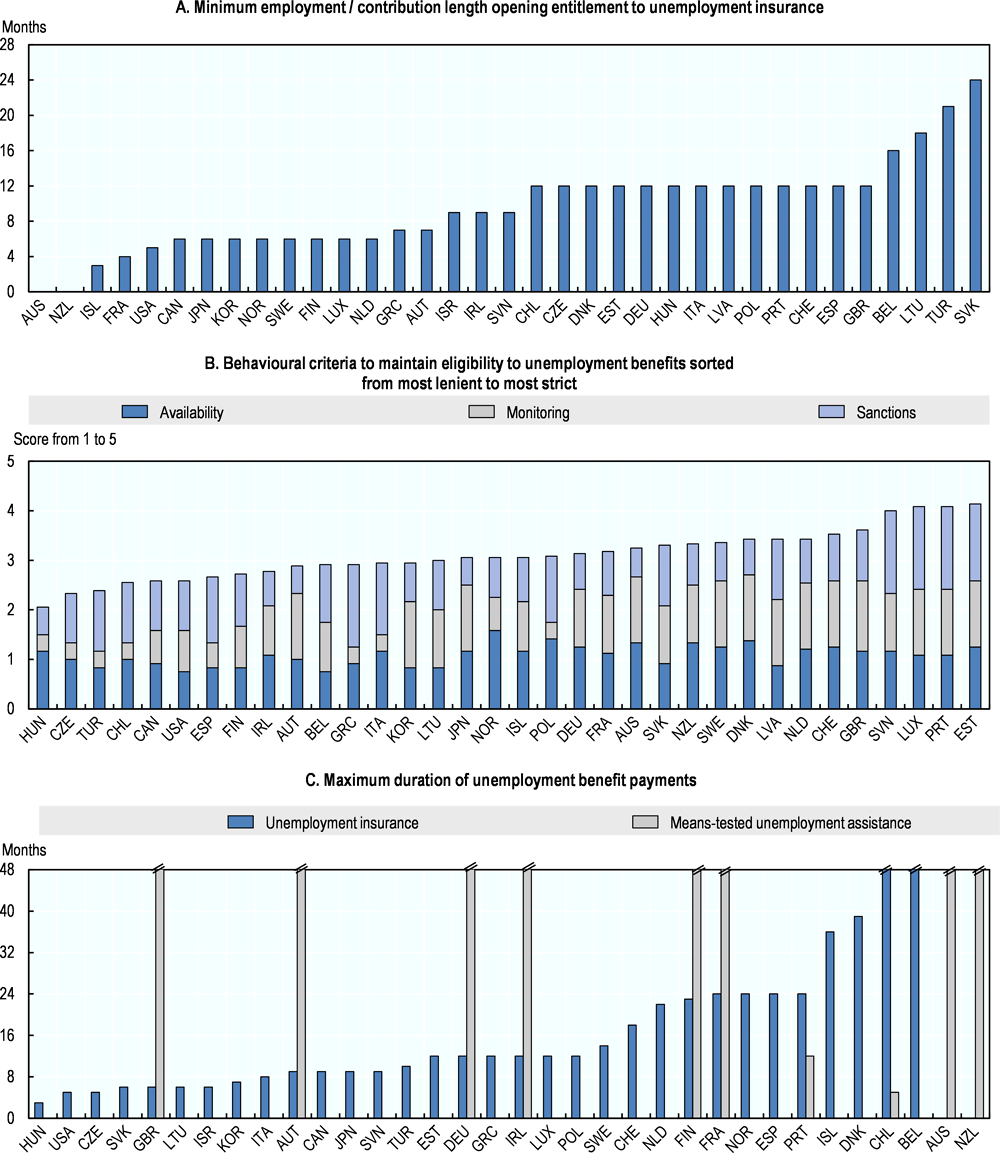

Social Protection Statistics Unemployment Benefits Statistics Explained

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Social Protection Statistics Unemployment Benefits Statistics Explained

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Social Protection Statistics Unemployment Benefits Statistics Explained

Social Protection Statistics Unemployment Benefits Statistics Explained

Social Protection Statistics Unemployment Benefits Statistics Explained

0 comments:

Post a Comment