The claimants must meet monetary eligibility criteria when applying for UI benefits one such being the base period. New Jersey will usually consider your claim effective as of Sunday of the same week that you file.

How Unemployment Benefits Are Calculated By State Bench Accounting

Instructions and Explanations Date Claim Filed.

Nj unemployment calculator. In addition to slogging through each states unemployment policies to determine each states unemployment pay outs we added the 600 a week included in the new stimulus package. New Jersey unemployment claims are dated for the Sunday of the week in which the claim is filed. Please select a date from which to base your claim.

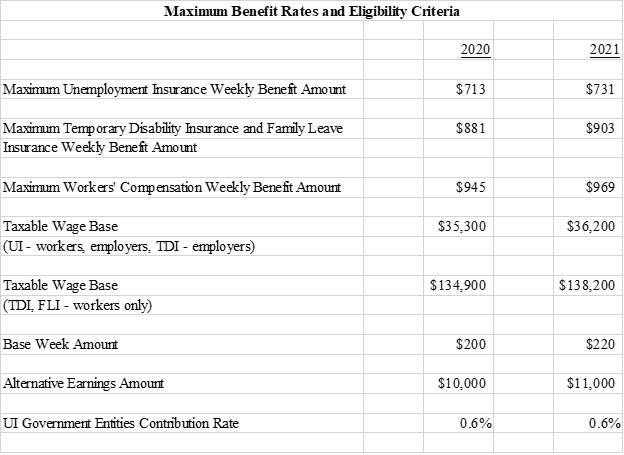

The weekly benefit rate is capped at a maximum amount based on the state minimum wage. Unemployment and Temporary Disability contribution rates in New Jersey are assigned on a fiscal year basis July 1 st to June 30. Additional Resources and Support.

This calculator uses the average weekly state benefit amount reported by the Department of Labor from January 2020 to November 2020 to calculate total unemployment compensation and. To make an additional contribution complete and return form UC-45 Voluntary Contribution Report. The wage base is computed separately for employers and employees.

See links to assistance with food housing child care health and more. Wage and Hour Compliance. Applying the Illinois unemployment calculation formula we see that if Jane files an unemployment claim her WBA will be 470.

New York for example has a UI Benefits Calculator on which you can enter the starting date of your original claim to determine how many weeks of UI Regular Unemployment Insurance Benefits you will receive. Use this calculator to see whether you may be eligible for unemployment benefits and to estimate the unemployment benefits that you may receive. This value is then multiplied by 47 and divided by 26.

To be eligible for unemployment benefits you must have earned at least 10000 in your base. Depending on the distribution of your quarterly pay the results may vary from your actual unemployment. Read our FAQs on paid leave job protection and caregiving.

Rates range from 04-54 on the first 36200 for 2021. January 1 through March 31. Enter the date that you filed your claim or will file your claim for unemployment.

In 2009 an applicant must have an average weekly wage of at least 210. If your claim begins between these dates. In New Jersey unemployment taxes are a team effort.

However Newark residents and any non-residents who work in Newark have to pay an additional city tax of 1. The average weekly wage thus calculated will be 1000 and the maximum benefit amount 584 maximum benefit for New Jersey. Know what is a base period and calculate your UI benefit amount using our base period calculator for unemployment.

To go back to the New Jersey Unemployment FAQ Page. At the lower end you will pay at a rate of 140 on the first 20000 of your taxable income. For 2022 the maximum weekly benefit rate is 804.

In your base period you must have 20 weeks where you earned gross wages totaling at least 10000. Federal benefits created during the benefit expired September 4 2021. Finally thats divided by 26 to get 470.

We will calculate your weekly benefit rate at 60 of the average weekly wage you earned during the base year up to that maximumWe determine the average weekly wage based on wage information your employers report. State Benefits Calculators. Check back later Were working in a really handy calculator to help you determine how much youll be able to collect in unemployment benefits every month.

4321-7c6 of the New Jersey Unemployment Compensation Law. Unemployment Insurance UI benefits are available to individuals who lost their jobs through no fault of their own. Wisconsin has a Weekly Benefit Rate Calculator that helps you figure out the amount of your unemployment.

Partial Unemployment Benefit Calculator If you work part time your benefits are reduced in increments based on your total hours of work for the week. Let us presume that an individual worked 20 weeks during the base year period and his weekly benefit is 200. October 1 2020 to September 30 2021 January 23 2022.

If you are single or married and filing separately in New Jersey there are seven tax brackets that apply to you. However this number is a good indicator of what you can expect. Your base period will be.

Both employers and employees contribute. New Jerseys unemployment insurance UI compensation system was rate calculator or the options of Partial Unemployment benefits If you received unemployment benefits this year you could owe Yet researchers estimate that only 40 of unemployment payments in 2020 had If you live in states like California Montana New Jersey. Meanwhile the highest tax bracket reaches 1075 on income over 5 million.

Thats the 26000 that Jane made in two quarters multiplied by 47 which is 12220. New Jersey Unemployment Calculator. The maximum New Jersey unemployment amount in 2020 is 713.

Employers can choose to make additional contributions to have their experience ratings recalculated per RS. You will still be able to receive benefits for eligible weeks prior to September 4 2021. Date Selection January 16 2022 Your base year will be.

This affects which quarterly earnings are considered as your base. In order to be eligible for partial unemployment benefits your hours must have been reduced to less than your normal work hours through no fault of your own you must work 30 or fewer hours in a. New Jersey Weekly Benefit Amount Calculator.

This division enforces labor laws that address conditions of employment and wages including overtime payroll deductions benefits hours of work breaks holiday pay employment certificates for minors etc. A base week is defined as one where you earned at least 200. New Jersey Unemployment Tax.

FREE Paycheck and Tax Calculators. You must file for Unemployment Insurance benefits in New Jersey if you worked in New Jersey in the past 18 months and moved out of New Jersey before becoming unemployed. You can file your claim online or you can call the Reemployment Call Center for out-of-state claimants at 888-795-6672.

For employers for 2021 the wage base increases to 36200 for unemployment insurance. This is only a screening tool and it does not guarantee you any benefits. All new employers except successors are assigned new employer rates for the first three calendar years after which a calculated rate is assigned based on employment experience.

Essay Brain Drain Problem India Essay Brain Drain Long Arm Quilting Machine

New Jersey Unemployment Calculator Fileunemployment Org

Tools That Will Help You Determine Your Unemployment Benefits

Unemployment Benefits For The Jobless

Genco Olive Oil Import Prices Are Not Showing Any Inflation As A Result Of Tariffs Or Any Other Reason As Mortgage Rates Mortgage Bond Market

Do You Know What Is An Emi Calculator Do You Know What Did You Know Emi

Nj Unemployment Benefit Rates Increase In Nj Started On January 1st

Youth Unemployment Essay Economics Summary Writing Essay Love Essay

Zip Code 19342 Profile Map And Demographics Updated March 2020 Coding Demographics Map

New Jersey Weekly Benefit Amount Calculator Unemployment Real World Machine

There Is No Justification For Cutting Federal Unemployment Benefits The Latest State Jobs Data Show The Economy Has Not Fully Recovered Economic Policy Institute

Base Period Calculator Determine Your Base Period For Ui Benefits

Post Construction Cleaning Calculator For Residential Cleaning Companies Construction Cleaning Cleaning Companies Residential Cleaning

Esdwagov Calculate Your Benefit

0 comments:

Post a Comment